Formed by a rectangular price range, the flag pattern occurs when a trend pauses and retraces slightly before continuing upward. This pattern gives us the opportunity to enter the market in the middle of a trend. The break out in price continues its original strong trend, gives us the chance to enter that trend at a better price than before the formation of the flag.The Bullish Flag is one of the most popular yet under-utilized chart patterns. When a price trend pauses and consolidates, this pattern occurs, called a flag. However, the Bullish Flag isn’t just pretty to look at, no, it’s a time for us to take advantage. Once the price breaks out from the top or bottom of the flag range, it continues its original upward or downward trend with more pullback in price, giving us a better buying opportunity than before the formation of the flag.

The bullish flag pattern gives us a good chance of entering the price at a better level during a trend. Lets examine this pattern in more detail. The bullish flag chart pattern is made up of: An initial uptrend Trend lines A rectangular shaped range with the upper trend line and lower trend line forming the point where they cross Flags break out in price Move your mouse over the chart to see the name of each part of this pattern. Uptrend When you see an uptrend, buy if it breaks out above its current resistance or below its current support levels. You can also enter a trade when an uptrend doesn’t break out, but forms a consolidation area. This leads to sideways movement within the trend and is called a trading range or consolidation area. Flag Chart Pattern Formation The rectangular shaped range is called the flag chart pattern formation or rectangular chart formation. Tracing Each trendy chart pattern move has its own tracing as seen on line 1 and 2 above. When we study where the price traced during an initial uptrend (1), we can determine how far it has traced during that trend . When we study how far the price went within its new established rectangle (2), we can determine how far this rectangle has traced from the original trendy stock trading price.

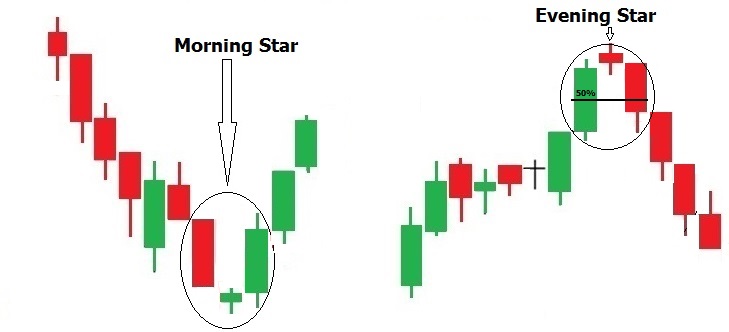

The evening star candlestick pattern is a bearish technical indicator. A evening star candlestick pattern develops when prices close lower than they opened and there are, typically, three candlesticks visible: a large-bodied candle opens lower and trades in a progressively narrowing range, then closes well off its open, while a small-bodied candle trades in a progressively narrowing range, also closing well off its open. The third candle is the “evening star,” which has a small body that gaps significantly lower than the close of the second candle. In other words, an evening star is a big top followed by two consecutive bottoms.

The Evening Star candlestick pattern is found at the end of short-term periods of bullish price action and indicates a possible market reversal to the downside. It is similar to the Inverted Hammer pattern, with an important difference: in the former, both real bodies are long; whereas in the Evening Star, one real body is short and the other real body is long. The evening star pattern tends to appear after a long advance has been followed by a significant decline.